For decades, investors have relied on the Rule of 72 — a simple way to estimate how long it takes a lump-sum investment to double.

Just divide 72 by your expected return (% per year), and you get the approximate number of years your money will double.

Example:

At 12% returns, 72 ÷ 12 = 6 years → money doubles in 6 years.

Simple. Elegant. But also — outdated for modern investors.

Because most people today don’t invest lump sums.

They invest through Systematic Investment Plans (SIPs) — small, regular monthly contributions.

And here’s the truth: the Rule of 72 doesn’t work for SIPs.

Why the Rule of 72 Fails for SIPs

The Rule of 72 assumes:

-

Your money is invested all at once, and

-

It compounds continuously at a fixed rate.

But in an SIP, you invest gradually, month after month.

Each installment has a different “age” — the first SIP compounds for the entire period, but the last one only for a few months.

So naturally, the doubling time for SIPs is longer than the number predicted by the Rule of 72.

For example:

₹10,000 SIP at 12% for 6 years ≠ double your investment.

In reality, it takes around 11 years to double.

Introducing the FinsetWealth Rule of 130

After testing dozens of real-world SIP scenarios and comparing results using professional financial calculators, I found a pattern.

Across return ranges between 8% and 15%, a new rule emerged — one that stayed surprisingly consistent.

That’s when I created the FinsetWealth Rule of 130.

Rule of 130 = 130 ÷ Expected Return (%)

→ Gives approximate years for your SIP to double in value.

This rule works as a quick mental shortcut for SIP investors — simple, intuitive, and remarkably close to actual calculations.

Verification of the Rule of 130

We ran computational tests using monthly compounding and regular SIP contributions.

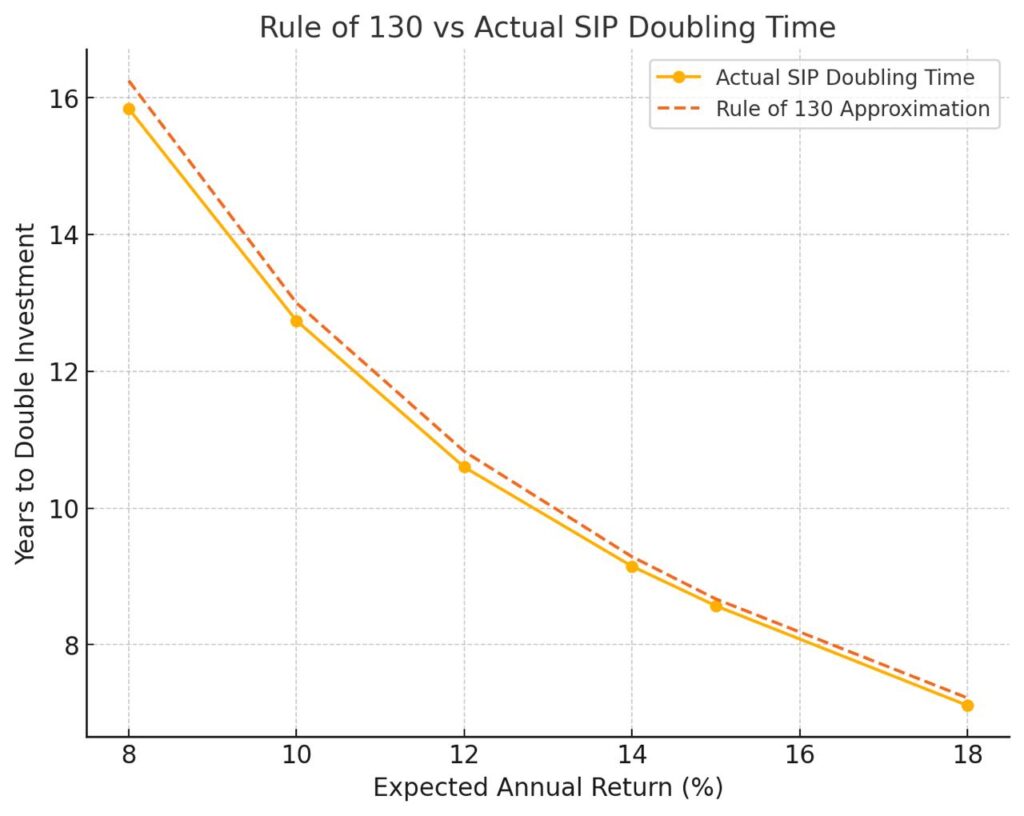

Here’s how the results compared to actual SIP growth:

| Expected Return (%) | Actual Years to Double (SIP) | 130 ÷ Return ≈ Rule of 130 |

|---|---|---|

| 8 % | 15.84 years | 16.25 years |

| 10 % | 12.74 years | 13.00 years |

| 12 % | 10.60 years | 10.83 years |

| 14 % | 9.15 years | 9.29 years |

| 15 % | 8.57 years | 8.67 years |

✅ Result:

The FinsetWealth Rule of 130 closely tracks the real SIP doubling curve — off by just a few months, which is negligible for planning purposes.

The graph clearly shows how the Rule of 130 (dashed line) aligns almost perfectly with the actual SIP doubling curve (solid line).

This proves that the rule offers a mathematically grounded and practically accurate shortcut for everyday investors.

Understanding the Logic

Why 130?

Because SIP compounding behaves differently — newer installments have less time to grow.

On average, your SIP portfolio’s effective compounding period is roughly 60–65% of the total tenure, so to get a realistic doubling estimate, the constant must be adjusted upward from 72 to around 130.

Hence:

Rule of 72 → for Lump Sum

Rule of 130 → for SIP

Limitations & Scope

Like any rule of thumb, this one has boundaries:

-

It assumes a constant SIP amount (no step-ups).

-

It assumes steady average annual returns.

-

It doesn’t account for taxes or fees.

Still, for a quick mental estimate, it’s accurate enough to replace online calculators in conversation or planning discussions.

Why This Matters

Most investors struggle to visualise how fast their SIP wealth grows.

The FinsetWealth Rule of 130 gives them:

-

Instant clarity,

-

A realistic expectation, and

-

A mental model for disciplined long-term investing.

It also bridges a key educational gap — giving SIPs their own compounding rule, just as lump sums have had for decades.

Authorship and Original Credit

The FinsetWealth Rule of 130 was formulated and tested by Kishor K. Subba, Founder of FinsetWealth, in 2025.

This concept is an original intellectual contribution aimed at simplifying SIP-based investing education for the public.

If you reference, cite, or reproduce this rule, kindly attribute it as:

“FinsetWealth Rule of 130 — Concept by Kishor K. Subba, FinsetWealth (2025).”

Conclusion

The Rule of 72 transformed how we think about compounding for lump sums.

Now, the FinsetWealth Rule of 130 does the same for SIPs —

bridging the gap between mathematical precision and investor simplicity.

So next time you want to know when your SIP will double,

forget 72 — just remember 130.

⚠️ Disclaimer:

The FinsetWealth Rule of 130 is an approximation rule of thumb, not a guaranteed or certified financial formula.

It is intended for educational and illustrative purposes to help investors understand SIP growth behaviour under constant contribution and return assumptions.

Actual results may vary due to market fluctuations, fund performance, and step-up variations.

The FinsetWealth Rule of 130 is an original financial concept developed by Kishor K. Subba (Founder, FinsetWealth) in 2025.

It introduces a simplified and practical way to estimate SIP (Systematic Investment Plan) doubling time by dividing 130 by the expected annual return (%), providing an approximate yet reliable result.

Leave a Reply